Key Points

Intuitive Machines is a significant player in lunar exploration, with successes in the Artemis program, but it faces financial challenges in a competitive space market.

The company’s revenue is driven by NASA contracts and the OMES III program, with efforts to diversify into commercial lunar data services offering the potential for growth.

Investors should consider Intuitive Machines’ recent earnings, the status of its lunar lander mission, and the inherent risks of the aerospace industry when evaluating the stock.

5 stocks we like better than Intuitive Machines

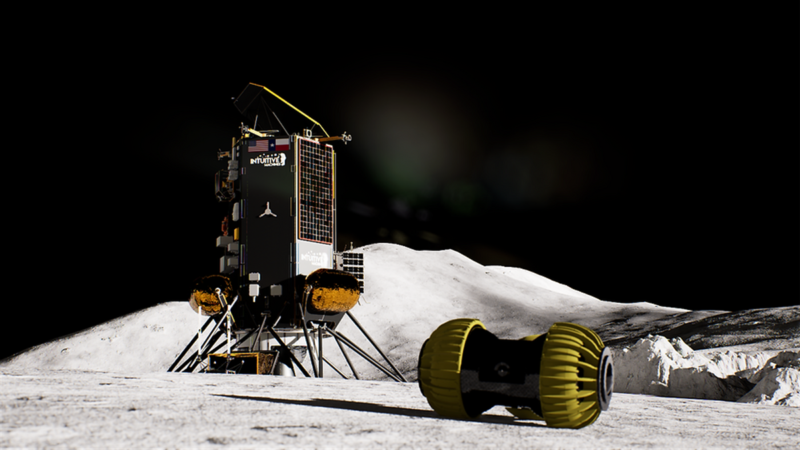

Intuitive Machines NASDAQ: LUNR has positioned itself as a pivotal player in the space exploration and aerospace sector, where ambition and innovation collide. Intuitive Machines embodies the spirit of the new space age from its historic lunar landing, marking the United State’s return to the Moon after a hiatus of over 50 years, to its expanding portfolio of lunar technologies and services.

Get Intuitive Machines alerts:Sign Up

Intuitive Machine’s earnings release for the fourth quarter and full year of 2023 (Q4 FY 2023) provides a detailed picture of the company’s financial performance and offers clues about its trajectory. After a successful lunar touchdown, has Intuitive Machines landed a compelling financial report, setting the stage for a long and profitable mission?

Houston, We Have Revenue Growth

The company’s latest earnings report reveals a mix of progress and continued challenges in Intuitive Machines’ financial performance. The company experienced a year-over-year revenue decrease. In FY 2023, revenue reached $79.5 million compared to $85.9 million in FY 2022. This decrease is primarily attributable to project milestones and contract completion timing.

NASA’s Commercial Lunar Payload Services (CLPS) initiative and the more recent OMES III contract are key drivers of the company’s revenue. It’s important to note that government contracts can have revenue recognition patterns that impact the timing of income reflected on financial statements.

While Intuitive Machines recorded a net operating loss of $(56.2) million in FY 2023, a narrower loss of $(5.9) million in the fourth quarter of 2023 is encouraging. This reduction in quarterly operating loss indicates efforts to rein in costs. Furthermore, achieving a positive gross margin in December 2023, primarily due to OMES III revenue, highlights improving operational efficiency.This positive margin signifies that the company generates an acceptable profit after deducting direct costs associated with delivering its lunar services.

Intuitive Machines ended 2023 with a solid backlog of $268.6 million, an increase from $201.9 million in the prior year. Backlog denotes contracted work yet to be completed and translated into revenue. Thus, this substantial backlog bodes well for future revenue potential.

The company’s cash position strengthened considerably, reaching $54.6 million by March 1, 2024. This increase resulted primarily from warrant exercises by an institutional investor, providing enhanced financial flexibility to pursue growth initiatives and investments.

Statements made during the earnings call indicated Intuitive Machines will continue to focus on innovation, strategic partnerships, cost control, and efficient execution of its expanding lunar programs. Navigating the cost-intensive aerospace industry remains challenging, but revenue growth, improving margins, a healthy backlog, and sufficient cash reserves offer encouraging signs.

Lunar Ambitions in a Competitive Orbit

Existing contracts secured within the Artemis program and the potential to win additional awards indicate that Intuitive Machines is likely to remain a fixture in NASA’s ambitious lunar plans.

Recognizing opportunities beyond government contracts, Intuitive Machines proactively seeks to participate in the burgeoning commercial lunar market. The company’s strategic focus on services such as lunar data gathering and analysis positions it as a knowledge facilitator in the rapidly evolving space economy.

If Intuitive Machines successfully monetizes lunar data and participates in developing lunar resource utilization efforts, significant new revenue streams could be unlocked.

However, it’s essential to acknowledge that Intuitive Machines is not the sole player in the commercial space race. Companies like Astrobotic and Firefly Aerospace also vie for dominance in lunar markets.

To maintain and expand its market share, Intuitive Machines must continuously refine its value proposition, highlighting the unique advantages of its services and technologies. Success in this competitive landscape hinges on demonstrating innovation and delivering reliable performance.

Countdown to Investor Impact

The current status of Intuitive Machines’ lunar lander is a critical factor for investors to monitor. The lander’s ability to successfully restart upon the return of ample sunlight to its South Pole landing site will determine the immediate outcome of the mission and likely significantly impact investor sentiment in the near term.

Positive news for Intuitive Machines on this front could boost the company’s stock price, while a failure to restart could lead to a decline.

Beyond the lunar lander, investors should closely track any recent news developments or announcements from Intuitive Machines. New strategic partnerships, contract wins, or leadership changes could signal positive momentum or potential challenges for the company.

Additionally, it’s crucial to pay attention to shifts in Intuitive Machine’s insider stock holdings. Major shareholders buying or selling sizable amounts of stock can convey either confidence in the company’s future or raise concerns about its trajectory.

Projects often have extended timelines, meaning that returns on investment may not be realized for years. Considering these inherent risks is essential when making informed investment decisions about any aerospace company, including Intuitive Machines.

Intuitive Machines embodies the spirit of the transformative age in space exploration. The company’s successful lunar landing, participation in the Artemis program, and push for commercial space activities underscore its ambition. Investors must carefully weigh the company’s strong revenue growth, promising backlog, and technological advancements against the operating losses, competitive landscape, and risks characteristic of the aerospace industry.

As Intuitive Machines continues to chart its course amongst the stars, staying attuned to company developments will guide informed investment decisions.Before you consider Intuitive Machines, you’ll want to hear this.MarketBeat keeps track of Wall Street’s top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on… and Intuitive Machines wasn’t on the list.While Intuitive Machines currently has a “Buy” rating among analysts, top-rated analysts believe these five stocks are better buys.View The Five Stocks Here Click the link below and we’ll send you MarketBeat’s guide to pot stock investing and which pot companies show the most promise. Get This Free Report