It’s a classic Disney movie plot: A family comes together to fight an enemy.

Only this time it is happening in real life, with the grandchildren of Walt and Roy Disney, who founded the company in 1923, joining forces to oppose Nelson Peltz, the activist investor who is waging a proxy battle for board seats. The heirs — nine in total, including Abigail E. Disney, who has at times been a harsh critic of Robert A. Iger, Disney’s chief executive — publicly lined up behind Mr. Iger and the current Disney board on Thursday.

“These activists must be defeated,” Roy P. Disney, 66, said by telephone. “They are not interested in preserving the Disney magic, but stripping it to the bone to make a quick profit for themselves.”

In a statement, a spokesperson for Trian Partners, the investment firm which Mr. Peltz runs, said: “We love Disney and recognize building on its rich history of delighting loyal fans is essential to its future success. Trian invests in great companies like Disney and helps them grow and thrive for the long term — and we have the track record to prove it at companies like P&G, Heinz and Mondelez.”

Mr. Disney, a grandson of Roy Disney, has three siblings: Abigail, Susan Disney Lord and Tim Disney. In a letter to Disney shareholders, which was viewed by The New York Times, they call Mr. Peltz and a handful of other activist investors encircling Disney “wolves in sheep’s clothing.”

“It is imperative that the strategy Bob Iger, his management team and the board of directors have implemented is not disrupted,” the letter says. Their cousins, grandchildren of Walt Disney, sent a letter of their own echoing those sentiments.

Abigail Disney, 64, whose 2022 documentary, “The American Dream and Other Fairy Tales,” attacked Disney for pay inequality, added by telephone, “I have my differences with Bob Iger, but I know for a fact that the worst thing that could happen to the company is Nelson Peltz.”

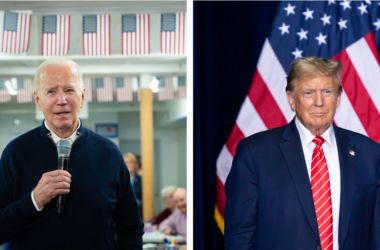

Mr. Peltz, 81, is campaigning for two seats on Disney’s board of 12, one for himself and one for James A. Rasulo, 68, a former chief financial officer of Disney who left in 2015 after being passed over as Mr. Iger’s heir apparent. Mr. Peltz is aligned with Ike Perlmutter, 80, a sharp-elbowed former Disney employee who is one of the company’s largest independent shareholders. Mr. Perlmutter, who sold Marvel Entertainment to Disney in 2009, was pushed out of the company last year.

Mr. Perlmutter had agitated — from his perch inside Disney — for Mr. Peltz to join the board in 2022. When he was rebuffed, Mr. Peltz started a proxy battle, saying he would cut costs, revamp Disney’s streaming business and clean up the company’s messy succession planning. He withdrew after Disney restructured and announced $5.5 billion in cuts. (It ended up closer to $7.5 billion.)

The pair re-emerged in October, citing Disney’s languishing stock price and the mishandling of Disney’s leadership succession plan.

“Fundamentally and crudely, we want the stock to go up,” Mr. Peltz says in a video message on Restore the Magic, a site that lays out his case for a board shake-up. In a video posted on X on Wednesday, Mr. Peltz said, “We love Disney. We think it’s part of Americana.”

This month, after Disney reported strong quarterly results and announced a partnership with Epic Games, shares spiked. Disney was trading at about $111.50 on Thursday, up 23 percent since the start of the year. Shares peaked at nearly $200 in March 2021, however.

The sparring around Disney extends beyond Mr. Peltz. Blackwells Capital, a hedge fund, is seeking three seats on Disney’s board, saying that Mr. Iger, 73, needs help navigating the fast-changing media and technology businesses; Disney opposes the effort. Another activist investor, ValueAct, is backing Disney amid the Trian and Blackwells challenges.

The proxy battles will come to a head on April 3, when Disney holds its annual shareholder meeting. (It will be conducted online.)

“I approach every day at Disney with a deep sense of respect for everything Walt and Roy created, and it is incredibly meaningful to have the support of their families,” Mr. Iger said in an email. “We are committed to protecting their legacy as we chart Disney’s path ahead.”

The Disney family has not been involved in managing the company since Roy E. Disney — the father of Abigail, Susan, Tim and Roy P. Disney — stepped down from the board in 2003. He subsequently led a shareholder revolt that resulted in Michael D. Eisner’s resignation as chief executive and Mr. Iger’s ascendance to the top of the company. Roy E. Disney died in 2009.

It is worth noting that the Disney family formerly ran an activist investment fund, Shamrock Holdings, which played a major role in the 2003 shake-up of what was also an underperforming Disney company.

Roy P. Disney said that he and his family members continue to hold shares; he declined to size the holdings, but analysts say that the Disney family has a relatively small position. He said that Disney did not solicit their help in its fight to fend off Mr. Peltz and his fellow activists. He said they decided to speak up because Mr. Peltz’s campaign reminded them of a bitter episode in 1984, when the corporate raider Saul Steinberg moved on the company. Mr. Steinberg was ultimately beaten back.

Mr. Disney and his siblings were joined on Thursday by five cousins (Walter Elias Disney Miller, Tamara Diane Miller, Jennifer Miller-Goff, Joanna Sharon Miller and Michelle Lund) who also expressed support for Mr. Iger, albeit with less emotion.

“As the family of Walt Disney, we support the Walt Disney Company management and its board of directors, and oppose the nominations put forth by Nelson Peltz,” they said in their letter. “There have been challenging times, but this current management has adjusted and grown through those challenges.”

Michelle Lund, whose mother, Sharon Disney Lund, was one of Walt Disney’s daughters, added in an email, “Disney started as a family company, and even though it has grown into such a big global business, Disney is still about family. My mother would be appalled by these activists’ attempts to force their way into the company.”

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.